Forex Trading is a dynamic realm where every move counts, and the ability to predict market trends can make a significant difference. Harmonic patterns, a cornerstone of technical analysis, offer traders a unique way to decode market movements. In this article, we’ll explore these patterns, their significance, and how mastering them can elevate a trader’s skill set.

Introduction to Harmonic Patterns

Imagine the Forex market as a canvas painted with intricate patterns, each telling a unique story of market movements. Harmonic patterns stand out amidst this tapestry, resembling hidden codes decipherable by astute traders. These patterns, rooted in mathematical ratios and derived from the Fibonacci sequence, offer a systematic approach to spotting potential trend reversals and continuations. In essence, they serve as the guiding stars in a trader’s journey, providing insights into market dynamics and shaping informed trading decisions. Understanding the basics of harmonic patterns lays the foundation for traders to explore the nuances of these powerful tools in the world of financial markets.

The Top 5 Harmonic Patterns

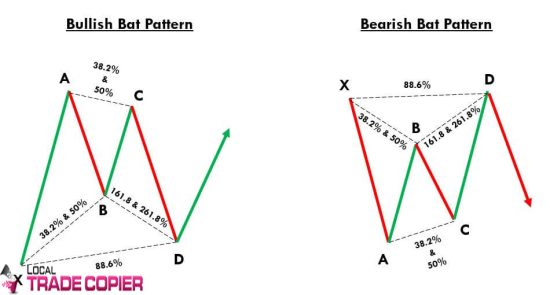

Bat Pattern

The Bat Pattern, a cornerstone in trading, is more than just a configuration on a chart; it’s a strategic roadmap for traders seeking potential market reversals. Derived from specific Fibonacci levels, this pattern offers a structured approach to identifying critical points in the market. Understanding its nuances and intricacies empowers traders to anticipate and capitalize on price movements effectively. It’s a tool that, when mastered, enables traders to navigate the uncertainty of the market with greater precision and confidence.

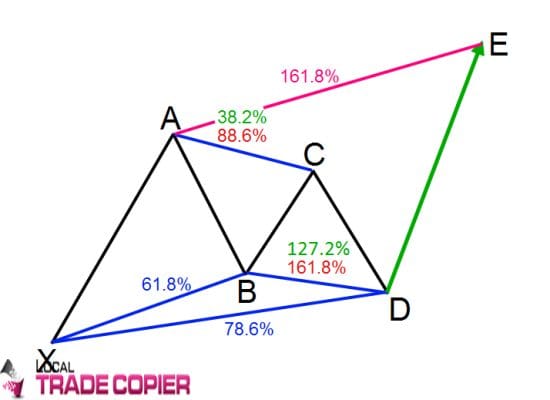

Gartley Pattern

The Gartley Pattern, a key element in the trader’s toolkit, is a Fibonacci-based formation revered for its ability to reveal potential trend shifts or continuations within the market. This pattern serves as a strategic guidepost, aiding traders in pinpointing critical junctures where market dynamics might undergo a significant shift. Mastering the intricacies of the Gartley Pattern equips traders with a lens to interpret market movements more accurately, enabling them to make informed decisions on entries, exits, and risk management. It’s a potent tool that amplifies a trader’s ability to navigate the ever-evolving landscape of financial markets.

Butterfly Pattern

Butterfly Pattern

Butterfly Pattern is characterized by its symmetrical structure and reliance on precise Fibonacci levels, is a trader’s compass for anticipating market reversals. Beyond its visual representation on a chart, this pattern serves as a strategic blueprint, offering traders a roadmap to foresee potential shifts in market dynamics. Mastery of the Butterfly Pattern empowers traders to not just recognize formations but to interpret them as pivotal moments, allowing for more informed decisions on market entries, exits, and risk management. It’s a powerful tool that sharpens a trader’s ability to decipher the intricate dance of financial markets.

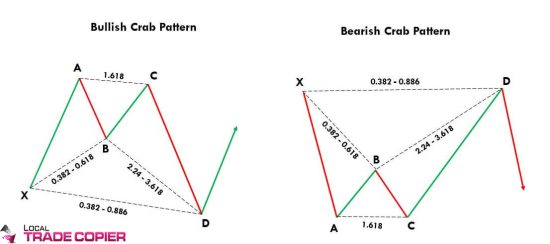

Crab Pattern

Crab Pattern

Crab Pattern is distinguished by its sharp and extended movements, and is a nuanced guide for traders seeking potential price reversals. Beyond its appearance on a chart, this pattern serves as a strategic indicator, offering traders insights into market shifts and potential turning points. Understanding the intricacies of the Crab Pattern equips traders to not only identify these formations but to leverage them as opportunities for informed decision-making in trading strategies. It’s a versatile tool that enriches a trader’s ability to navigate the dynamic fluctuations of financial markets.

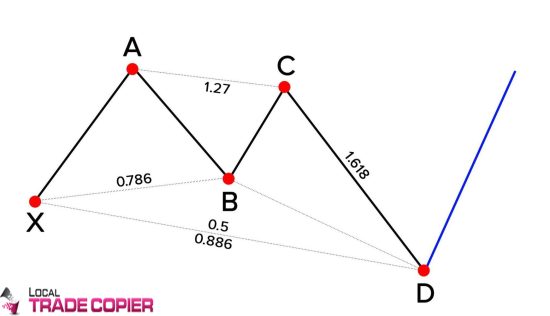

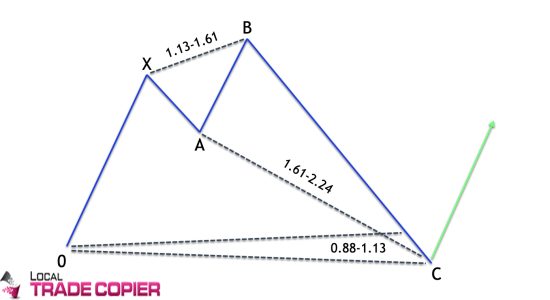

Shark Pattern

Shark Pattern

The Shark Pattern, despite its lesser-known status, holds a profound significance for traders seeking deeper insights into market conditions. Characterized by its unique formation, this pattern serves as a strategic indicator, allowing traders to identify potential trend reversals and specific market scenarios. Understanding the nuances of the Shark Pattern enables traders to discern critical moments within the market, offering valuable insights for decision-making. It’s a potent tool that, when wielded adeptly, grants traders an edge in navigating the complexities of financial markets with precision and foresight.

Why Should Traders Know These Patterns?

Why Should Traders Know These Patterns?

Understanding these harmonic patterns transcends mere chart analysis; it’s about empowering traders with a strategic advantage. These patterns serve as invaluable tools, offering insights into potential market movements and aiding in informed decision-making. By grasping these nuances, traders elevate their ability to foresee market shifts, identify entry and exit points, and manage risks effectively. Essentially, knowing these patterns isn’t just about recognition; it’s about gaining a competitive edge, enabling traders to navigate the intricacies of financial markets with confidence and precision.

Learning and Identifying Harmonic Patterns

Mastering harmonic patterns involves a journey of education and practice rather than a mere glance at charts. Traders delve into a realm of resources and tools, dedicating time to study and practical application. This immersive approach allows traders to fine-tune their pattern identification skills across diverse market conditions. It’s not just about theoretical knowledge but also about hands-on experience, honing the ability to recognize these patterns in real-time scenarios. Ultimately, learning and identifying harmonic patterns entail a continuous process of growth and adaptation, paving the way for more nuanced and confident trading strategies.

Conclusion

In the culmination of this exploration into harmonic patterns, it becomes evident that these insights hold immense value in the dynamic landscape of trading. The conclusion serves as a reminder of their significance, offering traders a strategic advantage in deciphering market complexities. It underscores the pivotal role these patterns play in enabling traders to make informed decisions, anticipate market movements, and navigate the financial terrain with heightened acumen. Ultimately, this conclusion emphasizes how harmonic patterns serve as a guiding light, empowering traders to navigate the ever-evolving market with confidence and precision.

FAQs

1. What makes harmonic patterns significant for traders?

Ans. Harmonic patterns serve as a guide, aiding traders in identifying potential market movements and assisting in strategic decision-making.

2. Are these patterns suitable for all market conditions?

Ans. While harmonic patterns can be applied across various market conditions, understanding their nuances is crucial for effective utilization.

3. How can beginners learn about harmonic patterns?

Ans. Beginners can start by studying educational resources, practicing pattern identification, and observing real-time market movements.

4. Do harmonic patterns guarantee successful trades?

Ans. Harmonic patterns are analytical tools. Success in trading involves a combination of various indicators, strategies, and risk management.

5. Can automated tools identify harmonic patterns accurately?

Ans. Automated tools can assist in pattern recognition but validating signals through personal analysis enhances reliability.