This is another story that was shared by one of my customers. This time he applies time filter to his trade copying campaign to avoid trading during Asian session.

This is part two of my articles series on the features in the new 2.1 version of the Local Trade Copier software. In part one I talked about how to use the new external Trade Filter Indicators to filter the trading signals received from my signal providers. You can read more about it by going here.

The second big change coming with the new version 2.1 is the filtering of trades by time. This is done with the simple drawing of rectangles on the chart. You can add an unlimited number of these time based filters to your charts.

You can use time based filters with the Server EA and the Client EA

You can create the time based filters on either the ‘’master’’ or the ‘’slave’’ account. This means that if you are a signal provider and you use an EA to trade your customers’ accounts, you can set the Server EA to avoid sending trades to customers during specified time ranges.

If you are a client that receives signals from a provider you can set the Client EA to ignore all trades that are received during certain time periods.

You can have unlimited number of these time ranges and they are very easy to create. You just need to draw a rectangle that covers the time period that you want to filter. You can do this by using the drawing tools in MetaTrader 4. But I will go into more detail regarding how to setup a time based filter bit later on. First we need to answer the following question: ‘’Why use a time based filter?’’

Why use time based filters?

You may ask why would I ever need such a feature as a time based filtering of trades? Here’s how I personally found the feature useful.

As the reader may know from my other writings, I use several signal providers to trade a part of my capital. No signal provider is perfect, they all have their strong and weak points. One of my signal providers was a scalper. In the first month of trading my account he delivered a 10 percent return while risking only 0.5 percent per scalping trade on average.

I was blown away by these results. I started to dream about what would happen if I just increase my trading size several times. I told myself: ‘’The max drawdown was only 4 percent. Even if I increase my trading size 10 times I would only have a 40% drawdown if he repeats the same result next month. But it would magnify my gains from 10 percent to 100 percent per month. I could double my money in a month! And if I double my money every month I would be a millionaire in…’

Well you know how those fantasies go. I was already starting to plan what I would do with my millions. Luckily by this time I already had a few years experience both with being a trader and following other traders so I chose to wait.

What looks too good to be true, usually is too good to be true

My previous experience taught me to wait. If there is one thing I have learned by being in the trading field these past few years is that what looks too good to be true usually is too good to be true. I told myself: ‘’Let’s wait until he has a few months of these kind of returns with low risk before I ramp up my trade size’’.

That was one of the smartest decisions I’ve ever made. The next month started out OK. He had a 5 percent return in the first week alone. I started to die a little inside. If I had just increased my size 10 times like I wanted, I would be up by 50 percent!

But again I waited. I have lost too much money in the past chasing the next big thing. I was burned too often to just jump in and risk 40 percent of my account on a signal provider I didn’t even knew about a month ago.

Second month, week two. Cracks start to appear

Second month, week two. The cracks finally started to appear. He was losing a percent or 1.5 percent every day for three straight days. Finally on Friday he lost 3 percent. Now his performance for the month was negative and in this week alone he exceeded his previous 4 percent maximum drawdown by losing 8 percent. I almost felt happy, I was right!

After my smug ‘’I was right’’ feeling started to fade away, I was hit with the realization that this guy just lost 8 percent of my money! This loss brought the total performance for the five weeks so far to a lousy 2 percent. Now a 2 percent return is better than nothing, don’t get me wrong. But a 2 percent return with a 8 percent max drawdown is nothing to write home about.

Together with the smug feeling, my ‘’dreams’’ that I would be a millionaire in few short months by following this guy also faded away. The reality of the trading business was once again shown to me in vivid colors – This is no get rich quick scheme!

Analyzing the trading record

I used the weekend to relax. Few days later, with a clear head and no emotions I started to go over the trading record. I compared the results in the first month to the second week of month two. Nothing unusual popped up, it didn’t look like he changed anything in his approach. The average loss and average gain were about the same, the only difference was that I was losing money somewhere.

Then it finally occurred to me to check his public account. To my surprise, the results for his account were a lot better. While I lost 8 percent in my account, his account was only down by 2 percent. ‘’Of course – this guy is a scalper!’’: I thought to myself. Because of the fast entry and exit times scalping results can vary greatly between different brokers due to execution and spreads.

I needed to find out who was his broker

I thought that what I needed to do was to find out who was his broker. I tried contacting him to get this information. He was reluctant to share this information, but after I threatened to unsubscribe from his signal service, he gave in and shared the broker info.

Few days later I was all set, or so I thought. I had opened an account with the broker he suggested and I was on my way to riches again! The spreads weren’t that great, they were especially bad in the Asia session, but the execution was top notch.

But it was all for naught. Week three didn’t go better then week two. In fact, this time he lost 4 percent in his account compared to just 2 percent in week one. Using his broker, I also only lost 4 percent too. This was an improvement over the 8 percent I lost in week two but it meant I was still losing money!

As the weekend rolled in, I decided to do a final analysis of his trading record before giving up entirely and closing my account with him. One thing that popped up to me were his trades during the Asia session. Lot of scalpers avoid trading during this time because liquidity is lower and thus the execution you get is worse compared to the execution during the busier times of the day. In addition to this, the broker we both used had really uncompetitive spreads during Asia that further compounded the problem.

I looked at his trades during the London session. Here his results seemed a lot better. I opened a spreadsheet and made three columns: Asia Session, London Session and New York Session. I entered all his trades for week two in the spreadsheet. After I was done, it was clear to me what his problem was. His result for the London Session in week two was a gain of 35 pips. For New York he had a +9 pips result. But in Asia, he was down by -139 pips. He was trading the wrong trading session for his scalping style.

I try to get my signal provider to stop trading during the Asia session

I contacted him again with my findings. I tried to make him stop trading in Asia. But like it usually happens in these cases, he wouldn’t even consider it. He got angry at me for even suggesting it. He told me the losses in Asia were temporary and he would soon start winning again. I asked him to look at his trading records. He told me abruptly: ‘’I don’t keep records, I’m a scalper not an accountant!’’. He stopped replying to my emails after that.

His comment that he would start winning again made me go back in time and check if this was true. Was he winning during the Tokyo session in month one when he gained 10 percent? Yes he was but only marginally. His Asia trades amounted to a +2.5 percent gain in the first month, while the rest of the sessions contributed the other 7.5 percent.

In conclusion, his overall trading result for the Asia Session and all seven weeks I had records for was a loss of 7 percent. He was literally bleeding money in Asia. The larger spreads and the execution were also taking a huge chuck of change out of his pocket and out of mine too!

But because he didn’t keep trading records, he couldn’t notice any of this. His mind focused on those first few weeks when he won 2.5% in Asia. For him, it was only a matter of time before he would start winning again.

I realized I had to take matters into my own hands. I would need to find a way to stop him from trading my account during the Tokyo session.

Local Trade Copier version 2.1 comes out

Few weeks earlier, I got an email from Rimantas, the creator of the Local Trade Copier. The email outlined the new features in the improved LTC version 2.1. I remembered that one of the features mentioned in the email was some kind of time based filtering of trades. But I had no idea what this filter could actually do.

So I fired up my Metatrader and started to play around with this feature. I will share how I setup my trade filter for the Asia session so you can do the same thing yourself if you need to.

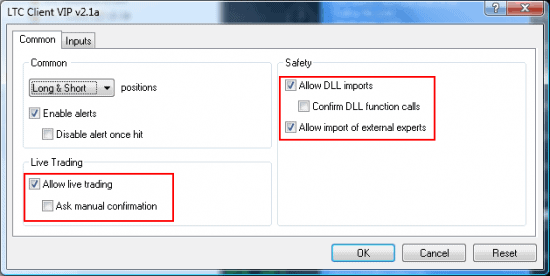

How to setup the Time Based Filters in the Local Trade Copier v 2.1

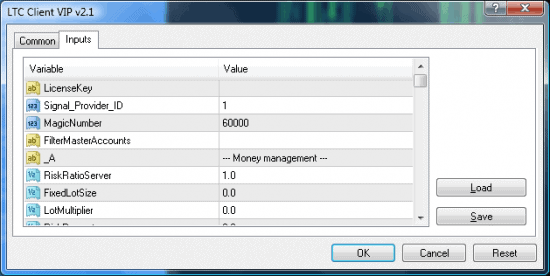

First we attach the Local Trade Copier to the chart. By now you should know the drill, but just in case for any new readers let me repeat the process of how you can do this. One way to do this is by simply dragging the LTC to the chart from the Navigator window. The second way involves right clicking on the EA and choosing ‘’Attach to chart’’. The following window will appear.

This is the inputs tab of the Local Trade Copier. Now you need to scroll down and find the feature called Rectangle Time Filter. You need to switch this feature from the default which is false to true as shown on the picture below.

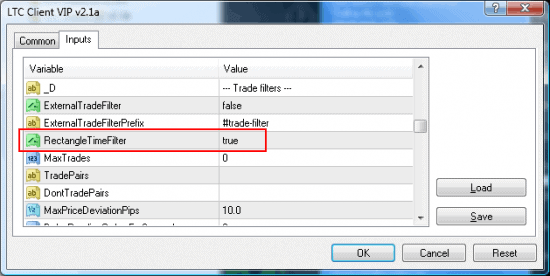

Before you click OK, make sure that you check the ‘’Common’’ Tab. The following boxes need to be checked in order for the LTC to work properly: ‘’allow live trading’’, ‘’allow DLL imports’’ and ‘’allow import of external experts’’. In addition, to avoid being flooded with alerts make sure to un-check the box called ‘’Confirm DLL function calls’’. The picture below shows exactly how you need to set up the ‘’Common’’ tab.

Now that we have the Local Trade Copier set up properly so it can recognize our time filters , it’s time to go into how to create these filters.

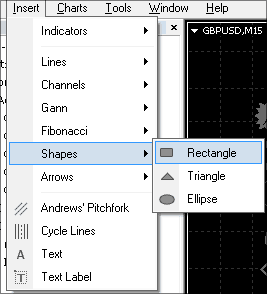

The process is very simple and intuitive. In order to create a time based filter you just need to draw a rectangle object that covers the area that you want to be excluded from trading. To draw a rectangle go to Insert // Shapes // Rectangle like it is shown on the picture below.

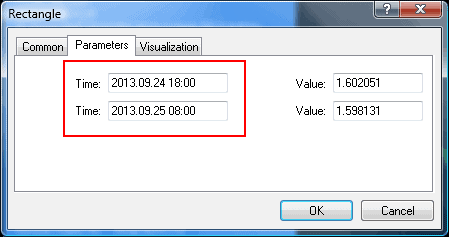

Now simply drag the rectangle and cover the time period you want to avoid. As I wanted to avoid the Asian session, the period I used was from 18:00 to 8:00. This covers a period that is slightly larger than the Asia session itself. It encompasses the whole ‘’slow’’ market period from the closing of the London Session to the opening of the European Session the next day. Please note that time on your MetaTrader 4 platform may be different because each Forex broker use different time zone. You need to calculate the right time for your broker and Forex market hours will help you do that. The picture below shows the Rectangle ‘’Properties’’ window.

You can open this window by right clicking on the Rectangle you just drew and choosing ‘’Rectangle properties’’. You will be presented with the ‘’Parameters’’ tab as shown on the picture above. If you suck at drawing, like me, here you can edit the time window manually by inputting the correct start and finish time. I used the time period from 18:00 to 08:00 as my time window.

By simply drawing a rectangle I managed to restrict my signal provider to trading only during the busiest trading period of the day. Pretty impressive for such a simple and easy to use tool.

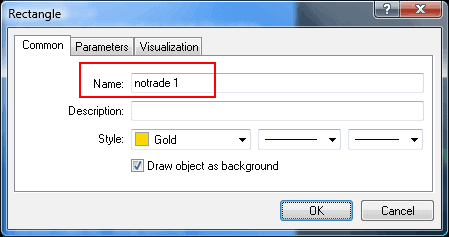

But we are not done with setting up the Rectangle. In order for it to function properly, we need to give it a name. The Local Trade Copier needs to detect the rectangle object and use it as a time filter. To accomplish this, you must use the prefix “notrade’’ in the name of the Rectangle.

To do this, switch from the “Parameters’’ tab to the “Common’’ tab in the Rectangle Properties window. In the “name’’ field you need to input the prefix “notrade’’ as shown on the picture below.

If you want to create multiple time filters and use multiple rectangles, you will have to add a number at the end of the name. Metatrader 4 doesn’t allow having objects with the same name. It doesn’t matter what number you add at the end of the rectangle name, as long as it’s not the same number. If you fail to name the Rectangle properly, the EA will not take it into consideration and won’t use it as a time based filter. The EA will only look for rectangle objects with names that start with the prefix “notrade’’.

Now that you’ve named the indicator correctly, just click OK and you’re all set.

There is one small change that is mainly cosmetic in nature and not needed for the proper functioning of the EA or the Rectangle time filter but may prove useful to you in the future in order to quickly see if the Rectangle is configured correctly. This is the “from … till …’’ message that appears above the Rectangle.

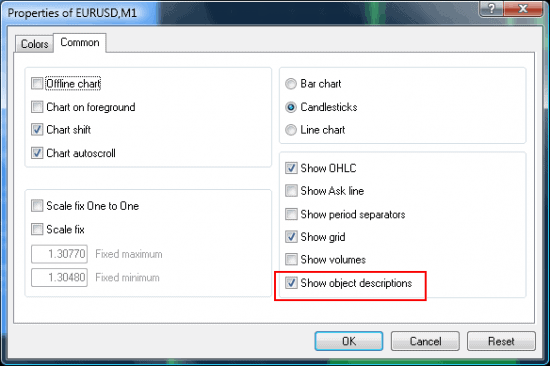

The default chart setup in Metatrader 4 will not show this “from … till …” message. In order to enable it, press F8 or right-click on the chart and choose Properties. In the new window that will pop up, switch to the “Common’’ tab and tick the box “Show object descriptions“ as shown on the picture below.

Now you will be able to easily see the time period that the Rectangle covers, it will be clearly displayed right above the Rectangle box.

The picture below shows my time filter for the slow market period all set up and activated. Notice the text above the Rectangle reads ‘’No new trades from 18:00 to 08:00’’.

In addition, as this picture was taken after 18:00, you can notice a text in the upper left corner that says ‘’LTC is idling until 08:00’’. This confirms that everything has been configured properly and informs me that the Local Trade Copier will not copy any new trades until the opening of the European Session early in the morning.

I hope that sharing my story will entice you to look for ways that you can use this feature in your own trading. Trade safe and remember – what looks too good to be true, usually is too good to be true.

Great!

JE voudrai une traduction e Francais Et pourquoi y a t’il un decalage de pips ‘3 ou 4) lorsque le copieur copie un ordre .

Hello,

i am using Google Translate to translate this text for other readers.

Unfortunately I cannot translate this article in french, but you can do this yourself with http://translate.google.com

The trade copy speed depends on Forex broker speed of execution, spread and many other factors. Please watch this video and read this article for more information.

http://www.ea-coder.com/mt4-trade-copier-copy-speed/

Regards,

Rimantas Petrauskas