Local Trade Copier for MT4 allows you to control the lot size on the client account in many ways. The software has many parameters to control the lot allocation. You can copy trades at the same percentage risk even when master and client accounts are of different size and different deposit currency or you can copy trades at your own set fixed lot size. You also have the ability to copy trades with the same lot size no matter what or choose one of few more advanced risk control settings.

In the Local Trade Copier version 2.9.7 risk parameters have been upgraded and look differently. I would say their names are self-explanatory but I still need to give a detailed explanation on each of them and that’s what I am going to do in this tutorial.

The old money management parameters for the older 2.9.6 version of the trade copier software are explained here.

Watch a full-length video presentation below… or watch particular short video sections as you scroll down

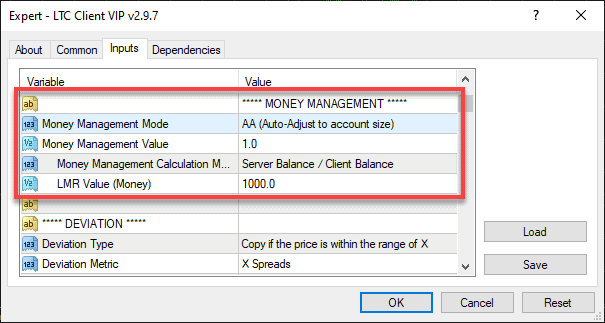

Local Trade Copier has (4) Four Money Management parameters

Money Management settings are organized in such a way that it is easy to use them. Also, by default, we’ve set the trade copier software to calculate lot size automatically according to the size of the master and client account so that you get the same risk in percentage on both accounts. It means that if you risk 1% on the master account the client account will risk the same 1% even if the account size is different (if that is possible).

You’ll notice that I use abbreviations in this tutorial like MMM which stands for Money Management Mode, for example. I do this to avoid mentioning those long parameter names over and over again. I am sure you get it 🙂

In the picture above, we see the Money Management section in the EA Inputs (settings). It has four parameters.

- Money Management Mode (MMM) – this is where you chose what formula should Client EA use to calculate the lot size when copying a trade on to the client account. Below you’ll find the detailed list of options.

- Money Management Value (MMV) – this is where you chose the value for the lot size calculation parameter (Money Management Mode). For example, if you chose to use a fixed lot size, then this value will be the lot size. If you chose a Lot Multiplier, then this value will act as a multiplier.

- Money Management Calculation Mode (MMCM) – this is where you chose whether the Client EA should use accounts’ balance or equity when calculating lot size.

- LMR Value (Money) – the LMR stands for Lot Money Ratio (explained below). The Client EA uses this value only when you select LMR as your Money Management Mode.

You control lot size on the client account using these 4 parameters and it is important to note that most of you won’t ever need the last two parameters.

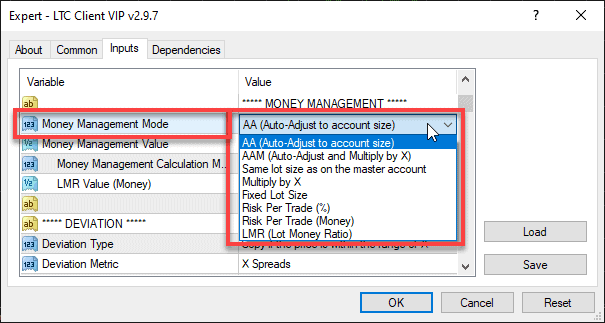

Here is the list of 8 available Money Management Modes:

- AA (Auto-Adjust to account size)

- AAM (Auto-Adjust and Multiply by X)

- Same lot size as on the master account

- Multiply by X

- Fixed Lot Size

- Risk Per Trade (%)

- Risk Per Trade (Money)

- LMR (Lot Money Ratio)

Now let’s take a look at each of those modes in detail.

“AA (Auto-Adjust to account size)” is the default Money Management Mode (MMM) and it makes the Client EA change the lot size proportionally according to the size of the master and client accounts. When MMM is set to AA, the Client EA does not use Money Management Value (MMV).

Here’s an example of how the AA (Auto-Adjust to account size) works. If the master account is $1,000 and the client account is $5,000, Client EA will copy 0.2 trade to the client account at the lot size of 1.0 (assuming the client account have the same or bigger leverage than the master).

The client account is 5 times bigger in this example, so the lot size will become 5 times bigger too. In such a case, if the 0.2 lot trade is a 2% risk on the master account, then the 1.0 lot trade will be a 2% risk on the client account too. This is the ideal way to copy the trades.

Note that the AA calculation mode takes leverage into account as well to protect the client’s capital. This protection is activated only if the client account leverage is smaller than the master account leverage. In such a case, the Client EA will lower the lot size on the client account to avoid margin call or stop-out. You can disable this Client EA behavior by setting IgnoreLeverageUsingAAM=false (this parameter affects the AA and AAM money management modes).

Let’s apply the same example as above, but this time master and client account leverage will be different. For example, if the master account is $1,000 (1:100 leverage) and the client account is $5,000 (1:25 leverage), Client EA will copy 0.2 trade to the client account at the lot size of 0.25 because the client account leverage is 4 times smaller. If the client account leverage would be bigger or the same as the master account leverage, the lot size would be 1.0, but because the client account leverage is 4 times smaller the Client EA makes the resulting lot size 4 times smaller as well.

“AAM (Auto-Adjust and Multiply by X)” is very similar to AA mode. It also makes the Client EA change the lot size proportionally according to the size of the master and client accounts, but additionally, it can also multiply that by your chosen number. When MMM is set to AAM, the Client EA will use Money Management Value (MMV). It is where you can enter the multiplier.

Here’s an example of how the AAM (Auto-Adjust and Multiply by X) works. Say we set the MMV=2.5. If the master account is $1,000 and the client account is $5,000, Client EA will copy 0.2 trade to the client account at the lot size of 2.5 (assuming the client account have the same or bigger leverage than the master).

The client account is 5 times bigger in this example, so the lot size will become 5 times bigger too. But because we have MMV=2.5 the Client EA will multiply the resulting lot size of 1.0 by 2.5 which will give the lot size of 2.5 for the trade. In such a case, if the 0.2 lot trade is a 2% risk on the master account, then the 2.5 lot trade will be a 2.5 x 2% = 5% risk on the client account.

Note that the AAM calculation mode takes leverage into account as well to protect the client’s capital. This protection is activated only if the client account leverage is smaller than the master account leverage. In such a case, the Client EA will lower the lot size on the client account to avoid margin call or stop-out. You can disable this Client EA behavior by setting IgnoreLeverageUsingAAM=false (this parameter affects the AA and AAM money management modes).

Let’s apply the same example as above, but this time master and client account leverage will be different. Say we set the MMV=2.5. If the master account is $1,000 (1:100 leverage) and the client account is $5,000 (1:10 leverage), Client EA will copy 0.2 trade to the client account at the lot size of 0.25 because the client account leverage is 10 times smaller. If the client account leverage would be bigger or the same as the master account leverage, the lot size would be 2.5, but because the client account leverage is 10 times smaller the Client EA makes the resulting lot size 10 times smaller as well.

When using multiplier it is essential to know that you can also lower the risk by using the multiplier number which is smaller than 1.

Here’s an example of how you can lower the risk when copying trades using the AAM model. Say we set the MMV=0.5. This would lower the risk in half. If the master account is $1,000 and the client account is $5,000, Client EA will copy 0.2 trade to the client account at the lot size of 0.5 (assuming the client account have the same or bigger leverage than the master).

The client account is 5 times bigger in this example, so the lot size will become 5 times bigger too. But because we have MMV=0.5 the Client EA will multiply the resulting lot size of 1.0 by 0.5 which will give the lot size of 0.5 for the trade. In such a case, if the 0.2 lot trade is a 2% risk on the master account, then the 0.5 lot trade will be a 0.5 x 2% = 1% risk on the client account.

“Same lot size as on the master account” option is quite self-explanatory. If you choose this mode, the Client EA will always copy the same lot size no matter what.

In this mode, the Client EA ignores differences in account sizes or leverage differences. MMV is unused in this mode.

Be careful when copying trades this way because if the client account is smaller you might get a margin call or get stopped out.

“Multiply by X” is another money management mode available in the Client EA. You can use this one when you want to copy the trades and alter the lot size by multiplying it by a specific number (multiplier).

In this mode, the Client EA ignores differences in account sizes or leverage differences. MMV is usable to set your desired multiplier.

You can use the multiplier to lower the risk or make it higher.

Here’s an example of how the “Multiply by X” works. Say we set the MMV=3. If the master account is $1,000 and the client account is $5,000, Client EA will copy 0.2 trade to the client account at the lot size of 0.6.

The client account is 5 times bigger in this example, but in this mode, the Client EA ignores account size or leverage differences. Because we have MMV=3 the Client EA will multiply the original lot size of 0.2 by 3 which will give the lot size of 0.6 for the trade. In such a case, if the 0.2 lot trade is a 2% risk on the master account, then the 0.6 lot trade on the client account can be of any risk depending on the account size. Be careful when copying trades this way because if the client account is smaller you might get a margin call or get stopped out.

“Fixed Lot Size” is the most primitive way to set the lot size for the copied trades.

In this mode, the Client EA ignores differences in account sizes or leverage differences. MMV is usable to set your desired lot size which will be always the same for all copied trades.

For example, if you set MMV=0.23 it means the Client EA will always copy all trades with this lot size.

“Risk Per Trade (%)” allows you to set your desired risk in percentage, for example, to risk 2% per trade. Client EA will use the size of the client account and a stop loss of each trade to calculate a proper lot size so that if the trade hits the stop loss it will lose no more than 2%.

In this mode, the Client EA ignores differences in account sizes or leverage differences. MMV is usable to set your desired risk in percentage.

Now let me give you a simple example of how the “Risk Per Trade (%)” works. For example, if you set MMV=5% it means the Client EA will always calculate the lot size accordingly so that if the trade hits the stop loss it will lose no more than 5%. Client EA will use client account size and a stop loss to calculate the proper lot size for that.

Important to mention, that when Client EA is using the “Risk Per Trade (%)” mode it will copy trades from the master account only when they have a stop-loss set. If there’s no stop loss set on the trade on the master account then the Client EA will delay such trades until they get a stop-loss set. In this operational mode, if master trades never get a stop loss set and then get closed they never make it to the client account.

If the master trade gets a stop loss set after 20 seconds when it got opened, the Client EA will copy this trade only after it detects the stop loss on that trade, which means there will be a delay of at least 20 seconds. After the trade is copied and the stop loss is removed from the master trade, the Client EA will remove the stop loss too, but the trade will remain open until it remains open on the master account.

However, in such a case, note that the trade is no longer risking the same percentage you choose with the MMV parameter as it no longer has stop loss. The same would be true if the stop loss gets set to a higher or a smaller value on the master account. Client EA would copy those stop-loss changes accordingly and the risk in percentage would change of course.

“Risk Per Trade (Money)” is very similar to the “Risk Per Trade (%)”, but it allows you to set the risk in money, for example, to risk $500 per trade. Client EA will use the size of the client account and a stop loss of each trade to calculate a proper lot size so that if the trade hits the stop loss it will lose no more than $500 (depends on the deposit currency).

In this mode, the Client EA ignores differences in account sizes or leverage differences. MMV is usable to set your desired risk in money.

Now let me give you a simple example of how the “Risk Per Trade (Money)” works. For example, if you set MMV=500 it means the Client EA will always calculate the lot size accordingly so that if the trade hits the stop loss it will lose no more than $500. Client EA will use client account size and a stop loss to calculate the proper lot size for that.

Important to mention, that when Client EA is using the “Risk Per Trade (Money)” mode it will copy trades from the master account only when they have a stop-loss set. If there’s no stop loss set on the trade on the master account then the Client EA will delay such trades until they get a stop-loss set. In this operational mode, if master trades never get a stop loss set and then get closed they never make it to the client account.

If the master trade gets a stop loss set after 20 seconds when it got opened, the Client EA will copy this trade only after it detects the stop loss on that trade, which means there will be a delay of at least 20 seconds. After the trade is copied and the stop loss is removed from the master trade, the Client EA will remove the stop loss too, but the trade will remain open until it remains open on the master account.

However, in such a case, note that the trade is no longer risking the same amount in money you choose with the MMV parameter as it no longer has stop loss. The same would be true if the stop loss gets set to a higher or a smaller value on the master account. Client EA would copy those stop-loss changes accordingly and the risk in monetary value would change of course.

“LMR (Lot Money Ratio)” is probably the most advanced money management mode in the Client EA.

In this mode, the Client EA ignores differences in account sizes or leverage differences. When the Client EA is using LMR mode, it will also use the MMV and “LMR Value (Money)” parameters. LMR stands for Lot Money Ratio. The Client EA uses this value only when you select LMR as your Money Management Mode. In the MMV you set the lot size and in the LMR Value, you set the money amount.

Here’s how the “LMR (Lot Money Ratio)” works. Let’s say MMV=0.2 and the LMR Value=1000. With these parameter values, the Client EA will risk 0.2 lots for every $1000. So if the client account size is $5,500, the Client EA will risk 0.2 x 5 = 1.0 lot per trade. Why 5 multiplier you ask? It is because the Client EA creates this multiplier by dividing the client account size by the LMR Value (5500 / 1000) = 5.5 and then takes only the whole number, which is 5 in this case.

As you can see, the MMV=0.2 sets the step for the final lot size increments (0.2, 0.4, 0.6, 0.8, 1.0, 1.2, etc.) and the LMR Value=1000 sets how often to increment the lot size (i.e. when account size is above $1,000, then when account size is above $2,000, next when account size is above $3,000, etc).

Here’s another example of how the “LMR (Lot Money Ratio)” works. Let’s say MMV=0.05 and the LMR Value=100. With these parameter values, the Client EA will risk 0.05 lot for every $100. So if the client account size is $5,500, the Client EA will risk 0.05 x 55 = 2.75 lot per trade. Why 55 multiplier you ask? It is because the Client EA creates this multiplier by dividing the client account size by the LMR Value (5500 / 100) = 55 and then takes only the whole number, which is 55 in this case.

As you can see, the MMV=0.05 sets the step for the final lot size increments (0.05, 0.1, 0.15, 0.2, 0.25, 0.3, etc.) and the LMR Value=100 sets how often to increment the lot size (i.e. when account size is above $100, then when account size is above $200, next when account size is above $300, etc).

Leverage of a client account affects the lot size

When you are using AA or AAM money management mode (MMM), the Client EA is always comparing client account leverage with the leverage of the master account.

If the leverage size match then it won’t affect the lot size.

However, if the leverage size of the client account is smaller than the leverage of the master account, it will affect the lot size by making it smaller as well. This is true when the MMM is set to AA or AAM.

Note that the lot size is affected only if the leverage of the client account is smaller. If the leverage of the client account is bigger it does not make the lot size bigger.

Example #1

Master account leverage 1:200

Client account leverage 1:50

Client EA has MMM set to AA (Auto-Adjust to account size)

The master account risks 1% per trade, but the client account will risk only 0.25% per trade (instead of 1%). It is because the client’s account leverage size is 4 times smaller (200 comparing to 50) and copying a trade at the same risk might damage the account. It might result in getting a margin call or being stopped out.

You can turn this behavior off by setting IgnoreLeverageUsingAAM=false.

Example #2

Master account leverage 1:5

Client account leverage 1:100

Client EA has MMM set to AA (Auto-Adjust to account size)

The master account risks 1% per trade and in this case, the client account will risk the same 1% regardless of higher client account leverage. Even though the client’s account leverage size is 20 times bigger the risk per trade in percentage for copied trades will not be affected to avoid account damage and unexpected results. If you want a bigger trade size in such a scenario, then use the AAM mode where you can increase it by using the multiplier which you can set using the MMV parameter.

Automatically adjusting lot size between accounts of different currencies

In a situation where the deposit currency of a master account is different from the deposit currency of a client account, the LTC trade copier may adjust the lot size according to the current exchange rate to preserve the same percentage risk/gain of a trade.

This is often misunderstood by newbie traders and they panic when they see a bigger lot size on the 100,000 EUR client account when the master account is 100,000 USD.

Let me give you an example.

SERVER Account: 100,000.00 USD

CLIENT Account: 100,000.00 EUR

Client EA has MMM set to AA (Auto-Adjust to account size) to preserve the same percentage risk/gain of each trade.

Master sends 1.0 lot from the USD account and the Client receives it as 1.18 lot to a EUR account.

So why the lot size is bigger on the client side even though the size of accounts is mathematically the same (despite the fact they are of different currencies).

The short answer is that it takes a bigger lot size on the EUR account to risk the same percentage on the EURUSD trade than it is for the USD account.

The longer in detail answer is this.

Client account size converted from EUR to USD ( for this example let’s use the EUR/USD rate of 1.1773) would look like this: 100,000 EUR * 1.1773 (EURUSD) = 117,730 USD

Client EA will treat client account size as 117,730 USD when calculating lot size for a trade from the USD master account. So it turns out the client account is bigger than the Master account by 1.1773.

This means 1.0 lot * 1.1772 = 1.18 lot for a Client account (rounded to decimal 2 digits).

When the 1.18 lot trade on a client close it will make a profit/loss of the same amount in percentage because MT4 will reverse back the currency conversion on that trade. In other words, many people mistakenly think that the bigger lot size makes higher profit/loss on an account of another currency when it actually does not.

In other words, if we take an example of a trade with a 1% risk when it has to risk $100 on the USD account and €100 on the EUR account, the lot size on the USD account will have to be smaller. It is because it takes a smaller lot size to risk $100 USD and a higher lot size to risk €100 EUR.

What to do if Client EA does not always use a fixed lot size when it is configured to?

If you set Client EA to use fixed lot size then there’s no way for the Client EA to use any other lot size. It’s just not possible.

However, there might be a couple of scenarios for misunderstandings.

Broker’s minimum and maximum lot size limitations

The first scenario might be if your broker does not allow the lot size you are trying to use (minimum and maximum lot size limitations).

For example, the broker has a maximum lot size limitation of 50 and you are trying to use a fixed lot size of 60 lots. The broker will deny such lot size and Client EA will be forced to use a lot size of 50 (maximum allowed by the broker). Obviously, there’s nothing you can do to override this because this is the limitation on the broker’s side. But you could use the SplitLots function in the Client EA to split that 60 lot trade into two trades of 50 and 10 lots.

Another example is if the client account broker has a minimum lot size requirement of 0.1 and you are trying to use a fixed lot size of 0.01. The broker will deny such lot size and Client EA will be forced to use a lot size of 0.1 (minimum allowed by the broker).

Partially closed trades change lot size

Another scenario might be if trades are closed partially (a.k.a. scale-out) on the master account. In this case, Client EA will repeat the same actions on the client MT4 account and when you get back to the computer you might see a lot size that’s smaller than your preset fixed lot size. But this is completely normal and interfering with this would usually ruin a trading logic of a strategy you copy. However, this might confuse some traders and they might mistakenly think that the trade was copied at a wrong lot size.

If you set Client EA to use a fixed lot size then it will always use a fixed lot size to open a trade, but as the time goes these trades might get closed partially on the master by your account manager or automated trading strategy you use (Forex EA). To copy the trades in a correct way Client EA will also close trades partially to maintain an exact same proportional copy of those trades.

For example, the master opens a 2.0 lot trade, and the client copies it at a fixed lot of 1.0 lot. Master closes half of the position (1.0 lot) and the rest 1.0 lot is left to run. So the client will close half of the position too (0.5 lot) and the remaining 0.5 lot will be left to run. Now when you see 0.5 running on the client you might assume that the Client EA copied it incorrectly when in reality it is all okay because it was copied correctly but then closed partially by the master later.

What if I think there’s a lot size calculation issue or mismatch?

What if I think there’s a lot size calculation issue or mismatch?

99 out of 100 cases when people think the trade copier miscalculated the lot size on a client account, they did not understand how the calculation works.

It could be a misunderstanding with the settings, different leverage, or different deposit currency of the master and client accounts.

However, there’s one more crucial point to understand. Lot calculation is just simple maths, after all. Simple maths.

At some point, even 1 EUR difference in account size might mean different lot sizes.

Example #1

Master account balance: 1000 EUR

Client account balance: 1099 EUR

Master lot size: 0.05

Client lot size: 1099 : 1000 x 0.05 = 1.099 x 0.05 = 0.05

Example #2

Master account balance: 1000 EUR

Client account balance: 1100 EUR

Master lot size: 0.05

Client lot size: 1100 : 1000 x 0.05 = 1.1 x 0.05 = 0.06

The difference in account size between example 1 and example 2 is just 1 EUR, but the lot size is different. That’s just how math works.

Conclusion

Study all these lot allocation methods well to understand which one will suit your business best. And trust me, we have put tons of hours to make it all work perfectly, but sometimes, on some Forex brokers, the MT4 platform is misconfigured, and it could be that no lot calculation algorithm can work well out of the box.

In such cases, we always take a closer look and try to adjust the software.

So if none of the above-explained cases explain what’s happening with your lot calculation, contact us through the contact form so we can help you.

hello i want to purchse the local trade copier…can i adjust the receiver lotsize to .01 and lot increement to .01?

There is no option for automatic lot incremental because Client EA will follow trade size from the master (and adjust it if necessary according to client account size).

But you can control copied trade lot size from many options.

Details here: https://www.mt4copier.com/risk-parameters/

I agree with your information

Is there any PDF User Manual for LTC?

Please let me know so I could download and read it first before purchasing

Hi there how much accounts can you connect to your own ea ?

Local Trade Copier is not limited to the number of accounts. It is limited to the number of computers depending on your chosen license. If your license is limited to one computer then you can use Local Trade Copier on as many accounts as you can run on that computer.

This is the best of all Forex Copier on board so far!!

Beside Forex pairs, it works very well with Volatility Index too!!

The software is real a marvelous peace.

Thumbs up to its developer

Thanks. I am glad you like it.

Hi Rimantas

I was hoping you could tell me how to fix a problem with my mt4 plateform I take a trade with a 0.05 lot which should pay a profit of 50 cents per pip but for some reason it only pays 5 cents per pip and I have $400.00. I use Oanda broker. I am going to finish checking out your site it looks good

Thanks Ron

It could be you have a cent account, and the lot size is different for your account. Normally, 1 lot is 100,000 units, but in your account, it’s probably only 10,000 units.

You should speak with your broker about this.